Commonwealth Central Credit Union: Website Redesign

About the Client

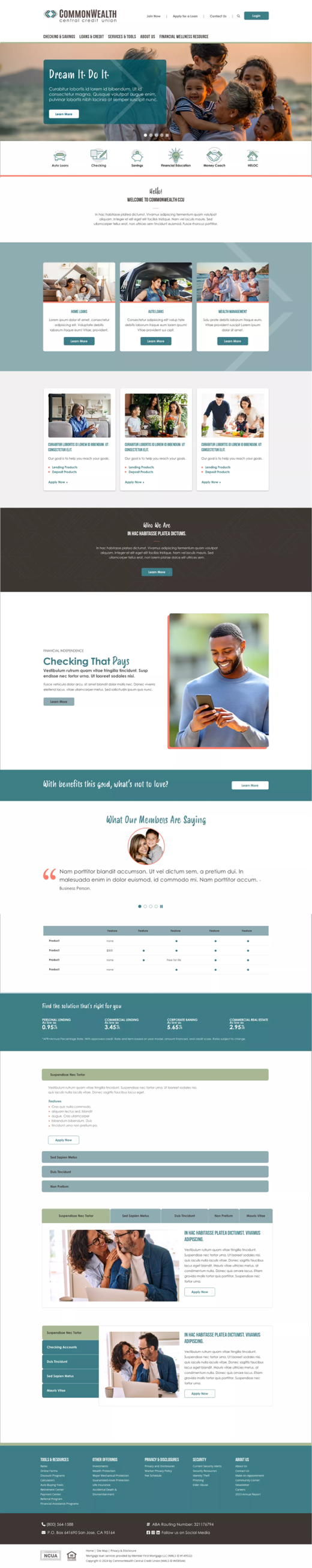

CommonWealth Central Credit Union is a not-for-profit, member-owned financial cooperative headquartered in San Jose, California. Established to serve the financial needs of its members, the credit union offers a comprehensive range of services, including savings and checking accounts, loans, credit cards, and digital banking solutions. With a commitment to personalized service and community engagement, CommonWealth Central Credit Union emphasizes financial education and accessibility, striving to empower its members to achieve their financial goals

Role: Lead UI/UX & Web Designer

I led the complete redesign of CommonWealth Central Credit Union’s public website, focusing on modernizing the visual identity, improving user experience, and increasing accessibility across devices. The redesign prioritized intuitive navigation, mobile responsiveness, and streamlined access to key member services such as online banking, loan applications, and financial education resources. I collaborated closely with stakeholders to align design decisions with brand goals, implemented a modular design system for scalability, and applied UX best practices to reduce friction and improve overall engagement across the site.

• Member-First Experience Strategy – Led discovery and user research to identify key pain points and designed a site structure that prioritized ease of access to everyday banking tasks and support resources.

• Modern, Accessible Interface – Delivered a clean, contemporary visual design system with WCAG-compliant accessibility baked in—enhancing readability, contrast, and navigability for all users.

• Mobile Optimization & Responsive Design – Designed a fully responsive experience to serve the growing number of mobile users, ensuring seamless interaction and consistent branding across devices.

• Simplified Content & Conversion Paths – Streamlined page layouts and calls-to-action to guide users toward high-value actions such as account openings, loan applications, and scheduling appointments.

• Collaborative Implementation & Scalability – Worked closely with developers and stakeholders to build a scalable, modular design system that supported future growth while staying on-brand and user-focused.